The digitization of banking systems is much like reliving the Blockbuster trajectory. Blockbuster’s decline because of the ignorance of consumer needs is a significant lesson that needs to be taken into consideration when studying the impact of digitization on banking.

Digital banking is optimally using the learnings from the same and is rapidly changing the landscape of the banking sector. Quicker support, better infrastructure and pricing, along with reliable frameworks, are the major needs of every consumer taken care of by various digital banking solutions.

How Digital Banking Solutions Empower Businesses and Consumers

1. Rise and decline—A new era begins

1.1 Rise of digital banking solutions during the pandemic

1.2 Evolution of digital banks

2. Current impact on consumers and businesses

2.1 How does it benefit the consumer?

2.2 How does it benefit the businesses?

3. Challenges in digital banking solutions

4. Acceptance rate

Conclusion

1. Rise and Decline—A New Era Begins

For an essential service, having limited access periods was definitely going to be a limiting factor for traditional banking. So when digital banking came with a negligible to zero requirement of physical presence, it was definitely going to be a blockbuster (in the actual sense) soon.

Traditional banking, however, still holds importance; there’s a reason it lasted for so long. The idea of not having physical assets and cash flow does break the sense of security in consumers. The trust factor is huge when it comes to money. Only after a dire requirement, which rose due to the unfortunate pandemic, was it possible to prove the ease, security, and benefits of quicker banking solutions.

1.1 Rise of Digital Banking Solutions During the Pandemic

The pandemic was a cannonball event that made as well as marred many industries at the same time. The banking sector, too, faced a surge in challenges due to limited access to the public and a resource crunch. However, bigger banks that had already launched their digital service discovered a gold mine. The banks found a customer base that was not only receptive but also eager to explore online banking solutions. But a few concerns still prevailed.

1.2 Evolution of digital banks

The sheer range of accessibility that digital banking solutions provide opens multiple avenues for businesses. The effect of quicker transactions creates a butterfly effect, which eventually results in the growth of the global economy and bridges the gaps between demand and supply.

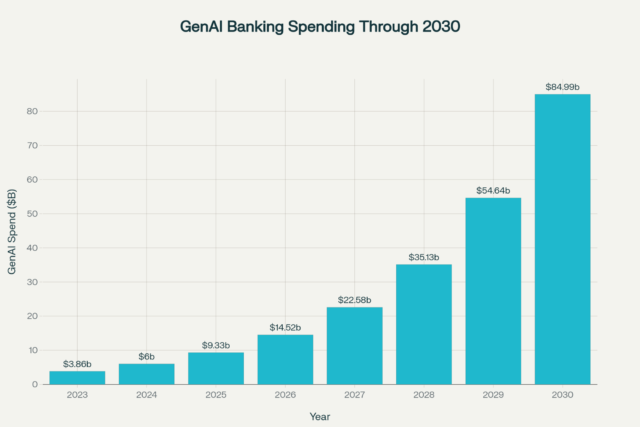

What we are about to witness in less than a decade today is something that hasn’t been possible for decades altogether. The changing socio-economic landscape is hitting the cast iron when it’s hot.

According to the KPMG report “The Future of Digital Banking in 2030,”

- By 2030, banks will leverage extensive, interconnected data sets from IoT and open banking to build comprehensive 360-degree customer profiles.

- Banks will evolve from product-centric providers to platform orchestrators offering personalized financial and adjacent lifestyle services, competing by delivering superior outcomes and experiences.

- Regulation will move beyond product-focused rules to outcomes-based frameworks, addressing technology risks like AI ethics while employing intelligent regtech tools for automated supervision.

- Mass personalization, automated services, secure digital identity, connected devices, immersive customer experiences, and new financial products are expected.

- The future bank will embed within customers’ lifestyles, anticipate needs proactively, simplify financial management through automation and AI nudging, and provide highly contextual, forward-thinking advice.

- Traditional banking products will be replaced with context-relevant finance and integrated financial services within lifestyle ecosystems or “super-apps.”

2. Current Impact on Consumers and Businesses

Consumers and businesses both benefit immensely from the digital banking ecosystem. Who doesn’t love a fast, efficient, and minimal-effort service? The world has become a small village, and so has the banking industry with it.

2.1 How Does It Benefit the Consumer?

Digital banking has significantly transformed consumer finance by offering convenient, secure, and personalized services available around the clock through mobile and online platforms. Customers benefit from faster loan approvals and seamless transactions, achieving a higher satisfaction rate. However, issues such as privacy concerns and the marginal global population that remains unbanked pose challenges.

2.2 How Does It Benefit the Businesses?

Digital banking offers businesses substantial efficiency and growth, with the global market projected to reach $1.61 trillion according to Statista. Neobanks and AI-driven fraud prevention have enhanced transaction speed and lowered operational costs by 20-40%. Mobile wallet transactions, surpassing $2.25 trillion, have improved commerce and market reach significantly. Additionally, investments in cybersecurity safeguard against digital threats, promoting financial inclusion and supporting economic development by integrating more consumers and businesses into formal financial systems.

3. Challenges in Digital Banking Solutions

Many consumers express concerns regarding security and privacy in banking, particularly about data protection and potential fraud, despite a general trust in banks. There is a demand for transparency regarding the use of AI and digital technologies, especially for personalized offers. Customers feel pressured to accept banking products that may not benefit them. Users expect seamless digital experiences, but some prefer access to physical branches for complex needs.

Financial inclusion remains an issue for unbanked populations, with digital banking often seen as inaccessible. Adoption rates vary across demographics, with older generations showing less comfort with digital banking. Customers seek personalized banking experiences, though there is caution regarding the use of AI. Reliability, operational resilience, and compliance with evolving regulations are also significant concerns for consumers.

4. Acceptance Rate

But even with the rising concerns, the convenience rate is grand. Consumers want to believe that these are cautionary concerns. Getting loan applications approved in minutes, having needs met on credit, automated money management, and simplified investments are far too seamless to give up on just yet.

Awareness, as we all have witnessed, is well taken care of through marketing campaigns. Some, however, have even accepted this as their fate. Money mishaps happen; it is a well-accepted, unfortunate truth. The amount is important here; as it increases, so does the graveness of the situation. In a nutshell, the customer base is still largely open for banks to get their deal together.

Conclusion

Banks need to digitize completely if they want to stay relevant. The clock is ticking, and we are not the pacemakers. AI at this point is of immense help and can rapidly transform the infrastructure of any organization. However, regulatory needs must be considered imperatively. The world has become a small village, and so has the banking industry with it.

Thanks to digital banking. The circulatory system of our economic ecosystem is banking, and it is important to ensure that the cash flow is seamless, nourishing, and controlled for a better tomorrow.

Stay Ahead of the Financial Curve with Our Latest Fintech News Updates!