David Thomasson, Chief Commercial Officer at Metro Bank discusses the banking and payments landscape and how a thrust has led to the optimization of the sector.

1. Tell us about your role in Metro Bank?

As Chief Commercial Officer I’m essentially responsible for developing the long term strategy around how we support our customers, grow our customer base, and drive sustainable revenue growth for the bank.

As such, my team manages and develops all of the products and services we offer to customers including how we support them digitally (mobile app, online banking etc) and use data to inform how we can better support them in the future.

2. Can you tell us about your journey into this market?

I’ve worked in and around retail banking for pretty much my entire career, which started at Barclays on their graduate programme. Over many years there I enjoyed roles in product management, call centre operations, marketing and change delivery. But after visiting on holiday, I fell in love with Australia and ultimately decided to move there, spending 10 very happy years in Sydney working for Macquarie Bank. At Macquarie I was fortunate enough to gain deeper experiences in business banking and really sharpened my knowledge of the payments arena and gained my first real exposure into digital banking. My family and I returned to the UK in 2017 and I was very lucky to find Metro Bank.

3. How do you think technology is changing the financial sector?

I think the finance sector has always relied heavily on technology, but there is no doubt that reliance is increasing exponentially.

There are so many ways in which technology is shaping what it is financial services organisations can offer to customers to meet their own changing needs and expectations, but also in the efficiencies that support organisations as businesses. To rattle off a few well-known terms – cloud, real time, always on, event-based triggers, cyber, AI, etc – all of these have had a massive impact and will continue to do so for many years to come. But I would also say that the financial services organisations that are winning are those that not only invest heavily in technology but also know how to use that to better serve customers. That’s something we at Metro Bank always have a keen eye on.

4. How has digitalisation optimised the banking sector?

Put simply, 95%+ of all interactions banks now have with their customers on a day-to-day basis are done digitally. That is a huge shift in terms of how customers want to interact with their bank, and how banks have learned to adapt and thrive on the back of that shift. It’s changed where banks are putting their resources and the way in which customers are choosing to engage with their bank(s). But in some ways, the trend towards digital within financial services has created some stark realities for many customers as they are increasingly pushed towards digital channels and find themselves without the ability to speak to or see other humans over the phone and above all in stores / branches. As an industry we need to be very careful we don’t all lurch to digital being the answer to everything and forget about the needs and preferences of our customers in how they engage with their bank.

5. The COVID-19 pandemic has enhanced the use of digital payment methods; what is your take on this?

We have learned more in the past 3-4 months than we would probably have learned in 3-4 years as a result of this awful pandemic and the restrictions it has imposed on us all. It is obvious that digital (and above all digital payments) have been the big winners out of that experiment. As a payments nerd, I’ve always been keen to give new payment types a go (perhaps earlier than most), but you just need to look around at the contactless or mobile payments being made in physical shops, or the sheer volume of delivery drivers scooting around towns and villages to see the huge shift to ecommerce and electronic payments en masse. Obviously these were growing trends before COVID-19 appeared, but I think we have seen critical mass adoption that is here to stay.

6. What are your predictions about the future of the banking sector, especially in the post-pandemic period?

Banks, just like most other businesses, are going to find things very tough in the short to medium term. Sadly, on the back of what we are seeing in the broader economy, many borrowers are going to find it difficult to repay loans and that will drive impairment volumes for all banks. I would not be surprised to see some degree of consolidation across the banking sector when banks are looking for ways to maintain their bottom lines at a time when revenues will be down by seeking cost efficiencies.

What is also clear is that there will be an increasing focus by banks on leveraging digital technologies to further reduce operating costs, be that in the way in which they serve customers (more features in mobile app, less branches) or in the way in which they seek to drive further efficiencies within their operational processes (automation, robotics, etc.).

7. Can you explain how your bank suits businesses and retailers?

Put simply we do everything we can to provide amazing service to our customers no matter how they want to interact with us. We have really good digital capabilities and great products and services but that is only part of our broader offering. I think we are the only bank in the UK that is actually expanding our store footprint and letting customers engage with other humans. We call it People-People Banking and we do it brilliantly.

8. What advice would you like to give to Start Ups?

Have a plan, stay focused and make sure you always have easy access to trusted advisors.

9. Which work related hack do you follow to enjoy maximum productivity?

I’m never sure that I’ve truly cracked this, but know that you need to look after all parts of your life, in order that you can give your best to your work.

10. How do you prepare for an AI-centric world?

Recruit talent, keep an eye on future trends and look for the use cases that are going to make a meaningful improvement for your customers.

11. What are the major developments you are planning, in recent times?

Back in early 2019 Metro Bank was fortunate to be awarded some money by the BCR to build out our SME banking capabilities. Since that point we have been working very hard to deliver a host of new products, services and stores to SMEs and momentum has been building. From what started as a few small capabilities launched late last year on our mobile app, we are now seeing a flood of new capabilities rolling out to all SMEs – like becoming a direct member of Bacs so we can allows businesses to take direct debit payments or enabling receipt capture through our mobile app. The snowball has gathered pace and size and we have a raft of exciting, new capabilities landing in the second half of the year.

12. Can you tell us about your team and how it supports you?

I’m lucky to have a great leadership team made up of some genuine talent and expertise who all work really well together. My life is so much easier because we stay close and stay focused on what we are collectively trying to achieve.

13. Which book are you reading these days?

I mostly read for pleasure before my head hits the hay these days and I love a bit of historical fiction (Bernard Cornwell, Conn Iggulden, etc). But I did recently chew through Stephen Denning’s ‘The Age of Agile’ and it worked wonders on re-energising me.

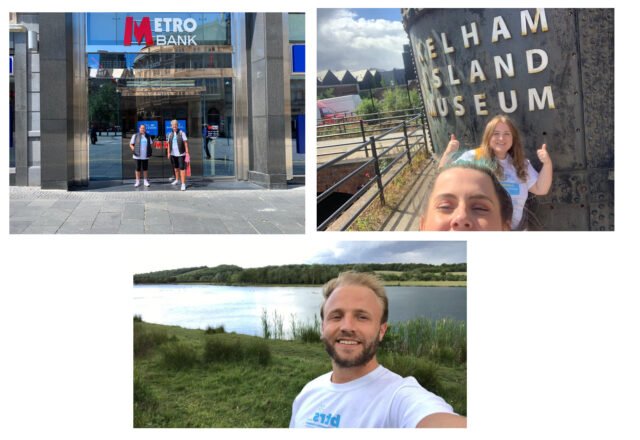

14. We have heard that you have a very joyful work culture, we wouldn’t mind having a look at some of the pictures?

We do indeed! We like to have as much fun as we can at Metro Bank. Yes, we’re a bank and offer a wide range of award-winning banking services, but we also like to create a fun and inclusive atmosphere both for our customers and our colleagues. Our Instagram and Twitter pages are awash with all of the stuff we’re up to in our local communities. Below are some highlights to give you a flavour…

Local community work from our store colleagues in Ilford:

Taking part in London Pride:

Our Sheffield store colleagues taking part in a mammoth physical challenge to raise money for charity:

We are BIG fans of dogs. All of our stores welcome in our customers’ dogs with treats and water bowls:

15. Can you give us a glance of the applications you use on your phone?

I’m pretty ordinary when it comes to apps – WhatsApp, Facebook, BBC News, Spotify, LinkedIn, etc – but as any parent of young children will tell you the iPlayer Kids app from the BBC is essential. And being a lover of 90s music – even if I can’t always remember the names of the songs or artists – I love a bit of Shazam!