The global financial trajectory has been highly influenced by the urgent need to shift its attention towards climate change. The urgency of the decarbonization of the world has resulted in excessive propagation of sustainable practices, ecological investments, and the rapid rise of green finance. Every industry has faced the consistent need for the progression of sustainable practices.

The Paris Agreement and the European Green Deal are key drivers of this growth, raising awareness about regulations and investment risks among all stakeholders. Technologies like AI and blockchain are helping investors, corporations, and governments make green finance more transparent and efficient.

Table of Contents

1. Green Finance and Sustainable Development

2. Challenges in Green Financing

3. Impact investment to the rescue

4. The Strategic Impact on Finance and Markets

5. Evolution of Impact and Green Finance

Conclusion

1. Green Finance and Sustainable Development

Sustainable finance significantly impacts all asset classes by promoting a greener economy through the integration of environmental, social, and governance (ESG) criteria in investment decisions and risk management. In fact, there is a strong trend in the market where ESG information is being put into the reports of investors as it slowly but surely becomes a part of the major investment value chain.

ESG components are considered to be the main criterion in regard to risk evaluation for insurance companies, and they differentiate the risks into three groups: physical, transition, and liability. For banks, ESG risks can determine the creditworthiness of a borrower, thus enabling the banks to offer sustainable loans by incorporating environmental impacts into their risk assessment and pricing strategies. Institutional investors also apply ESG factors to manage their portfolios, identifying both risks and opportunities.

2. Challenges in Green Financing

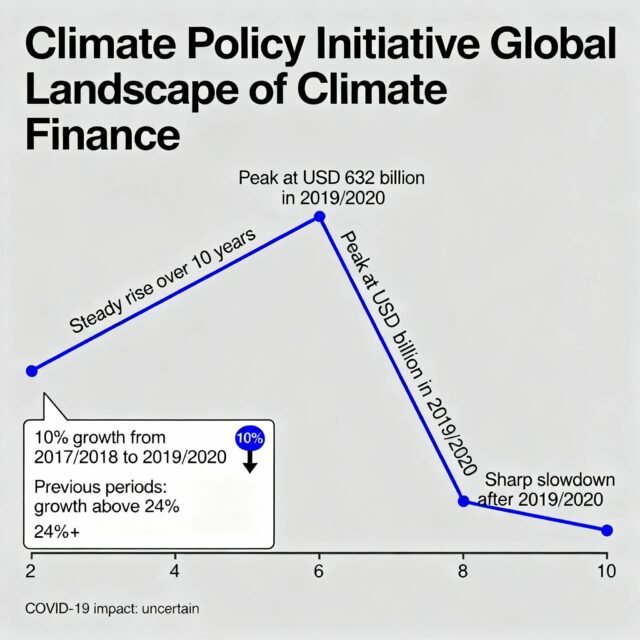

The Global Landscape of Climate Finance 2021 report from the Climate Policy Initiative indicates a constant increase in climate finance during the past decade, reaching USD 632 billion in the 2019/2020 period. However, there has been a slackening in climate finance flows in recent years. This situation raises concerns in light of the fact that the total effect of COVID-19 on climate finance is still not clearly estimated. Annual climate finance inflows from 2017/2018 to 2019/2020 grew by just 10%, compared to previous periods with growth rates above 24%.

Strict legal restrictions, coupled with softer market demands from parent companies and foreign investors, shape the operating environment of financial firms in Emerging Markets and Developing Economies (EMDEs). This often results in a divided industry where some companies move quickly towards sustainability while others remain at the same level, which leads to inequalities.

Larger subsidiaries and foreign companies might have to comply with very strict environmental key performance indicators (KPIs), and this can turn out to be a disadvantage for them when competing against local companies that have less stringent obligations. This situation discourages the proactive adoption of green finance practices due to the fear of losing customers.

3. Impact investment to the rescue

Impact investing prioritizes funds for businesses, assets, or projects that generate both financial returns and social or environmental benefits. The market for impact investments has been growing to the point of recording almost 29% as the annual growth rate. This advancing trend has been mainly pulled by the investors’ insistence on seeing the sustainability that has been backed with evidence and also by certain regulations like the EU’s Sustainable Finance Disclosure Regulation (SFDR), which has been tightening the norms of transparency and reporting.

Impact investing is a diverse area that covers various themes, such as renewable energy production, environmentally friendly farming, providing healthcare that is affordable, and giving more people access to banking. The most recent trends indicate that investor specialization has been intensified and that their chosen sectors include circular economy solutions, biodiversity conservation, carbon capture, and low-carbon technology. The other side of the trend is the emergence of sophisticated measurement frameworks and industry-wide standards that are being adopted to ensure that the changes brought about are genuine and quantifiable, to eliminate “greenwashing,” and to align incentives with long-term sustainability goals.

4. The Strategic Impact on Finance and Markets

The integration of impact and green finance is influencing market dynamics and risk assessments in various ways:

- Risk Mitigation and Value Creation: Investment in sustainable assets can substantially lower the risk of incurring regulatory penalties, getting part of the asset stranded, and suffering losses due to climate, and on top of that, it can attract new pools of capital.

- Changing Corporate Strategy: along with it, companies are being pressed more and more from all sides, be it shareholders, consumers, or policymakers, to not only hold strong ESG claims but also to incorporate climate risks into their core strategy and eventually be able to show impact-driven performance.

- Regulatory and Technology Enablers: The cooperation of national and international rules and advanced technologies (AI-powered analytics, for instance, and blockchain for traceable impact measurement) is increasing transparency, which helps to provide angel investors with a nice and clear view and the investors with even less risk of being deceived by greenwashing.

5. Evolution of Impact and Green Finance

Nowadays, financial institutions are incorporating sustainability into their main lending and investment policies. Top global and regional banks (e.g., Intesa Sanpaolo, Bank of America, and the growing group of Asian and African lenders) have pledged to green finance with multi-billion-dollar support through the link to corporate governance and executive perks.

Green banks, which are either public or quasi-public entities, play a vital role in the market by making it more attractive for investments. They do so by taking the risks out of clean energy and resilience projects, aggregating the investment demand, and supporting the issuance of green bonds, as well as climate-aligned financial instruments. Their catalyzing function has been essential in creating the necessary investment project pipelines in areas that are usually underfunded or technically uncertain (e.g., grid-scale storage, distributed renewables, or climate-resilient infrastructure).

The paradigm-shifting impact investment funds are using blended finance to leverage their investments in climate adaptation (water supply, agricultural practices that can resist climate change), advanced healthcare, and the financial technology that caters to the unbanked. They are thus making the shifts in their different areas of operation through high-impact results benefiting the communities and improving returns for private investors. The OECD’s Blended Finance Guidance and World Economic Forum case studies confirm that targeted de-risking and technical help are still key to large-scale institutional investor mobilization in developing countries.

Conclusion

The initiative is crucial for ensuring a sustainable future and resource preservation. Businesses are increasingly adopting ethical practices, driven by financial support from green finance. However, as time passes, the regulations start to change too. Even though the practices are sustainable, the framework that guides it isn’t. Regulatory bodies need to define better strategies for intensifying the regulations. Companies need to strategize their moves serially with consistent increases over a period of time. But the question still remains: is it a win for both sides? Or is one choosing to go down for the future?

Stay Ahead of the Financial Curve with Our Latest Fintech News Updates!