An organization typically handles large numbers of invoices weekly, rendering manual transactions of invoice data into back-office systems time-consuming while causing delays in accounts payable processes.

The current evolution of financial technologies makes digital invoicing an effective method to achieve better

invoice accountability while standardizing information across all potential systems, including merchandisers, GL coding, and revenue tracking and reconciliation processes.

Digital invoicing enables automated invoice processing, which uses AI and cloud computing together with Optical Character Recognition (OCR) for solving problems in financial operations with zero errors and complete efficiency.

This article explores how invoice digitalization and its software will impact your business and forecast the upcoming trends in the financial industry.

Table of Contents

1. Understanding the Concept of Invoice Digitization in 2025

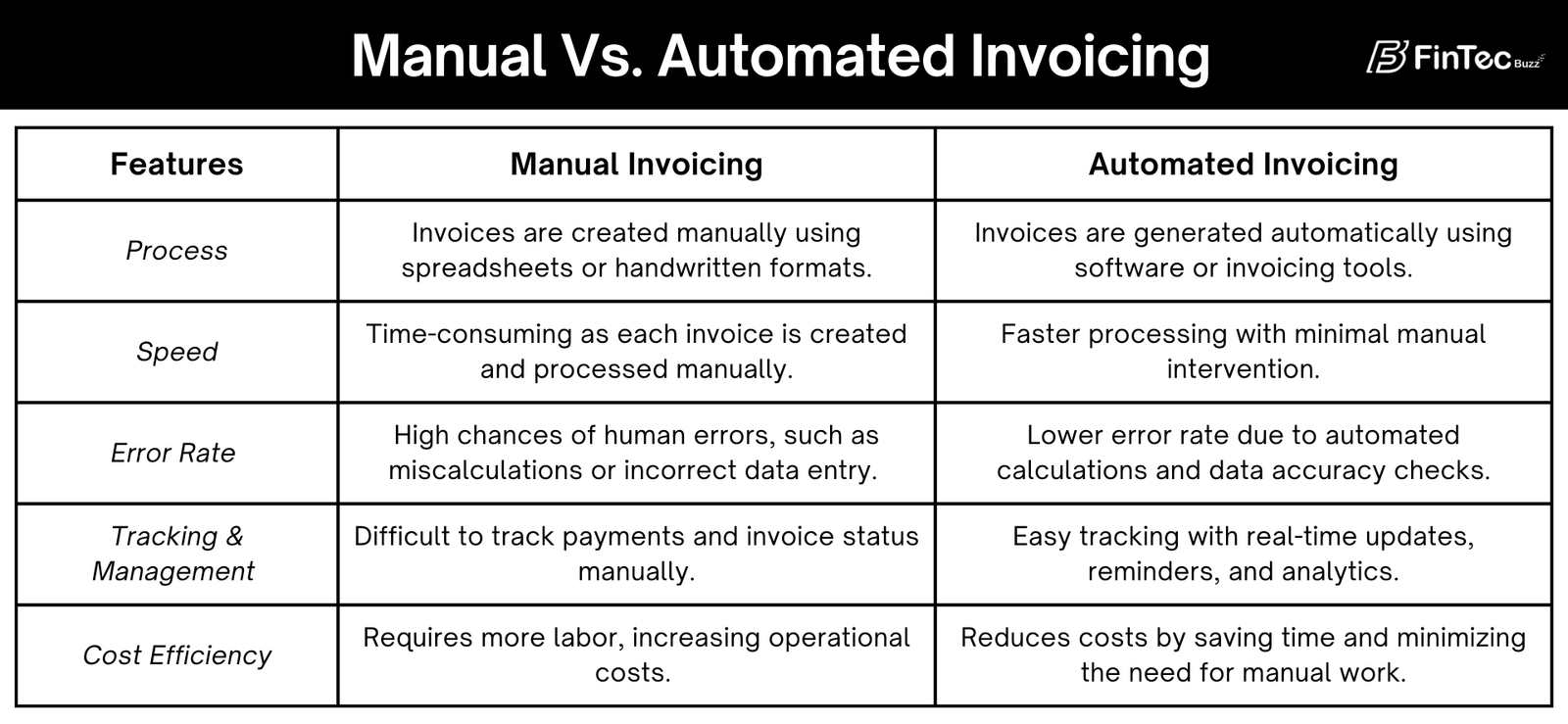

2. Difference Between Manual Vs. Automated Invoicing

3. Five Steps to Digitize Invoices With OCR

3.1. Scan and Upload Invoices

3.2. OCR Processing and Data Extraction

3.3. Data Validation and Error Checking

3.4. Integration with Accounting and ERP Systems

3.5. Fraud Prevention and Compliance

Conclusion

1. standing the Concept of Invoice Digitization in 2025

The financial sector has come a long way from traditional paper-based invoices to modern invoice digitization that uses cloud-based invoicing solutions and a combination of OCR with AI-powered invoicing to maintain payment tracking along with proper tax compliance.

Recent governments of regions such as Europe and Latin America have started to adopt e-invoicing into their systems to achieve faster payment cycles along with enhanced financial accuracy and substantial cost savings. The automated invoice reconciliation process reduced both human mistakes and fraud risks, which has established invoice management systems as essential tools for contemporary organizations.

2. Difference Between Manual Vs. Automated Invoicing

3. Five Steps to Digitize Invoices With OCR

The OCR technology of the 21st century helps businesses convert paper invoices or scans into machine-readable

text through its digital document processing capabilities. The following list demonstrates how to establish

digital invoicing with OCR, which can enhance your accounts payable automation while improving financial data precision.

3.1. Scan and Upload Invoices

To start, you need the process of the invoice digitization strategy: scan the paper invoice or upload digital

versions into an invoice management system. Once uploaded, you can digitally secure it in cloud-based invoicing platforms such as Zoho Invoice and FreshBooks and can easily retrieve invoice data regardless of where they are located.

3.2. OCR Processing and Data Extraction

After the invoice uploaded into the system, an OCR engine analyzes the content to extract the invoice number,

vendor information, payment conditions, line items, and tax data. You can take help from AI-powered invoicing

solutions such as ABBYY FlexiCapture and Kofax to detect invoice formats, fonts, and languages, which makes them suitable for global electronic billing cases. Therefore, using OCR for invoices leads to improved financial data precision together with automatic integration into reconciliation systems, which creates consistent financial

records.

3.3. Data Validation and Error Checking

After OCR processing, an automated invoice processing system cross-checks extracted data against purchase

orders, supplier records, and contracts. You can rely on invoice automation software such as AvidXchange,

Tipalti, and SAP Concur to receive automatic invoice protection through their invoicing systems. These tools

also have an inbuilt automated system that checks tax compliance alongside invoice evaluations to verify that

invoices follow regulatory requirements, eventually protecting businesses from possible legal consequences and

financial penalties.

3.4. Integration with Accounting and ERP Systems

The integration of OCR-extracted data works seamlessly with accounting software and ERP platforms, including

SAP, Oracle NetSuite, and Xero. These tools provide real-time financial reporting results from ERP integration,

which eliminates all manual invoicing data responsibilities. It streamlines the process, becoming simpler to

generate invoices and send them online, eliminating the processing time delays.

3.5. Fraud Prevention and Compliance

Automated invoice processing offers tremendous advantages in minimizing fraudulent activities during invoicing. You can find AI-based anomaly detection features that have inbuilt tracking systems to identify unexpected changes in vendor data and payment duplication along with invoice overcharges. With automated invoicing into the picture, you can enjoy full compliance with international tax regulations that cover GST, VAT, and IRS standards hassle free.

Conclusion

Digital invoice systems transform business operations by delivering improvement to precision, effectiveness, and adherence to rules. Organizations today implement digital invoice systems through OCR-powered invoicing and cloud-based invoicing solutions to decrease costs and avoid manual processing mistakes. Documented invoices that run through automated processing produce faster payment cycles along with perfect accounts payable management.

Stay Ahead of the Financial Curve with Our Latest Fintech News Updates!