The C-Suite and Board of Directors of America’s community banks and credit unions are experiencing unprecedented challenges brought to their doorstep from every angle imaginable. The speed of change in the 21st century of U.S. banking is breathtaking on one hand while stimulating on the other. Here’s why.

The Century of Tectonic Change and Events, with the Consumer (Still) in Control

As a result of the events of September 11, 2001, the Great Recession, and the Global Pandemic, the U.S. Federal Reserve Bank held the fed funds rate below 2.5% for 17 of the first 24 years of the 21st century. That was unprecedented in U.S. history.

As hoped for, low borrowing rates led to an engaged consumer. Today, consumer credit in the U.S. (a record $5T, up from $2.7T in 2008) is 185% higher than the months leading into the Great Recession.

Let that sink in for a moment. We wanted an engaged consumer, and we got one.

Bank and credit union (depository) balance sheets only somewhat demonstrate the increase in credit (December 31, 2024; S&P Global): The total U.S. Credit Union loan to share is 80+%. The total U.S. Bank loan to deposit is 65%.

Where have all the loans gone since 2008, if not at a depository? Historically, depository loan-to-deposit ratios would be much higher, given that total consumer credit is nearly double.

The answer? Fintechs and neo banks. They now account for 28% (personal loans) and 69% (mortgage loans) in the U.S., and their numbers continue to grow.

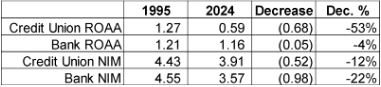

For further proof that banks and credit unions are experiencing material change, consider that in years past, a good economy typically led to higher net income for banks and credit unions. But not anymore.

The cost of technology for U.S. depositories has obviously impacted earnings, but the hidden cost of technology is the impact on the margin. Technology’s disruption includes how it has weaponized the consumer’s ability to discover the best rate on loans and deposits via the mobile phone, laptop, or tablet – driving loan yield down and cost of funds up, effectively squeezing margins on both ends toward the middle.

This technology-driven margin squeeze is a long-term trend and seems likely to continue for another reason – the oversupply of choice. The U.S. had an oversupply of lenders before fintech began making loans in 2005 and before Amazon, Goldman Sachs, Apple, Walmart, and others offered financial services products and solutions.

In our interactions with executives and board members, we provide research and analysis on these and other “baker’s dozen” drivers of consolidation. The discussions lead to a heightened awareness of the magnitude of both the challenges and opportunities of today’s banking landscape.

Strategic Considerations For Growth-Minded Depositories

Clients looking to achieve or retain economy of scale while generating competitive income have some choices and decisions to make. We are at an inflection point, and it seems to us that, at a strategic level, the financial institutions happiest in 3-5 years will best their competition at the following (referred to as “The Three-Legged Stool” of Strategic Planning):

- Achieving organic growth above your market and national average on a sustained basis.

- Become amongst the most productive at mergers and acquisitions.

- Begin (or continue) to partner with selective fintechs.

Over the past 10 years, we’ve enjoyed advising FIs on the why, how (and how not) to partner on mergers with other depositories or engage with fintechs or non-banks for new business. If done right, fintech partnerships complement growth by adding customers, loans, and net income. Fintechs aren’t bogged down by legacy, inflexible core systems, and they use social media channels to attract, add, and retain consumers on many loan types: personal, auto, home improvement, mortgage, and home equity, among others.

Many fintechs have key personnel with a depository background. They also understand the need for and have the knowledge to protect consumer information and operate within federal and state regulations. Some have been working with credit unions and banks long enough to have generated billions in loans to hundreds of thousands of new members/customers, thus earning trusted partner status with the depository. Many of the FIs partnering with fintechs enjoy a higher ROA than the average.

FIs looking to accept the reality of how U.S. banking has evolved and willing to embrace “The Three-Legged Stool” can potentially enjoy a lift in growth and earnings. Depositories partnered with fintechs can leverage their strengths and realize a go-to-market strategy featuring enhanced sales, marketing, and technology prowess that goes to work for the credit union and bank.

Fintechs have the flexibility and speed to reach a well-defined customer base in need of credit. When the need for credit, customer demographics, and the types of assets are aligned, the depository benefits from new business and earns a household likely to need other financial services.

Of course, managing the balance sheet to concentration limits on assets that complement the interest rate risk profile is a necessary part of the best partnerships. We stress that an open and frequent dialogue on the volume expectations of both parties is a must. This way, both parties can reliably run a successful partnership.

Stay Ahead of the Financial Curve with Our Latest Fintech News Updates!

Peter Duffy , Managing Director of Merger Advisory Services at SRM

Pete Duffy serves as Managing Director of Merger Advisory Services at SRM and has more than three decades of experience in financial services. Prior to joining SRM, Duffy spent 20 years at Piper Sandler, where he guided financial institutions through the development and execution of their merger and acquisition strategies.

Peter Duffy

Peter Duffy serves as Managing Director of Merger Advisory Services at SRM and has more than three decades of experience in financial services. Prior to joining SRM, Duffy spent 20 years at Piper Sandler, where he guided financial institutions through the development and execution of their merger and acquisition strategies.