Starling, the leading UK digital bank, has today welcomed Nutmeg, by recent reports the UK’s largest digital wealth manager, to its fast-growing Marketplace. The new service will help Starling’s personal and sole trader customers connect their banking to their investment accounts and pensions, as they prepare to navigate the new year ahead.

Founded almost 10 years ago, Nutmeg’s aim is to help people achieve their financial goals by empowering generations of investors. This new integration will give Starling’s growing customer base the ability to keep track of their pension and investment balances all within the Starling app – allowing them to always have a full picture of their finances at their fingertips.

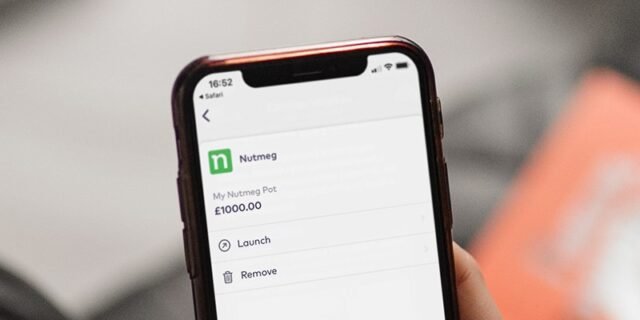

Starling customers with a Nutmeg account can connect to it through the Marketplace, while those without one will be able to sign up through the Marketplace. Once connected, they’ll be able to benefit from Nutmeg’s offering, which includes fully managed and socially responsible pension portfolios, with a minimum investment of £500. For the same minimum amount customers can also benefit from investments in the form of a general investment account and stocks and shares ISAs, and for a lower minimum of £100 customers can invest in a Lifetime ISA or Junior ISA for their children. There are no fees for signing up to Nutmeg, but there is a fee when an investment is made.

Helen Bierton, Chief Banking Officer at Starling Bank says: “By developing smart integrations with the third party platforms popular with our customers, such as Nutmeg, Starling is making it easier for customers to keep track of their money wherever it is located.”

Matt Gatrell, Chief Operating Officer at Nutmeg says: “We know that helping people to have a clearer picture of their full financial circumstances is crucial, and even more front of mind at the moment. So, we’re pleased to be connecting with Starling, to give Nutmeg investors and Starling customers greater oversight of their finances in order to support them in reaching their financial goals.”

For more such Updates Log on to https://fintecbuzz.com/ Follow us on Google News Fintech News