The organizational goals can be easily attained through a fundamental financial plan. Every person or business must have calculated data on their expected future earnings and expenses. A financial plan outlines budgeting and allocating funds by evaluating the set goals of the organization. It is necessary for an organization to have clarity in short- and long-term financial goals to get the best framework of a financial plan.

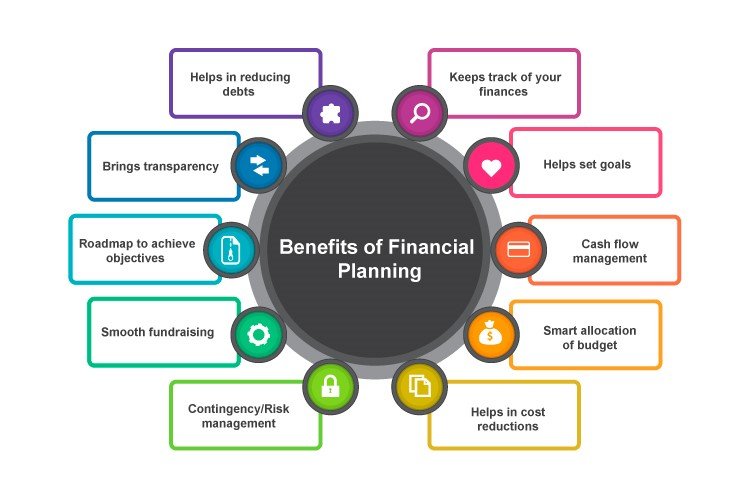

Financial choices can be made easily in accordance with the intended objectives. However, it also involves unforeseen expenditures, and it is essential to review and track the progress of the financial plan. Keeping an eye on the plan is beneficial for money management. Therefore, carefully thought-out financial arrangements inspire and foster confidence in people and businesses. As a result, well planned financial strategies aid in business decision-making.

Better financial planning increases organizational standards and improves the performance of businesses

The main focus of developing strategies is to pool financial resources and allocate them sensibly to support organizational growth. Making reliable plans for the inflow and outflow of money is necessary because it aids organizations in maintaining stability in this competitive environment. Organizations, for instance, concentrate on choosing between investing in liquid and non-liquid assets. Similarly to this, the most important factors in an organization’s financial planning are its financial resources, time for investment, and decisions regarding dividends to shareholders.

Superior financial planning keeps track of the organization’s income, costs, and savings. An accurate allocation of funds is made possible by effective financial planning. Utilizing financial resources effectively enables the development of reserves and the control of surplus funds. In addition, creating a customized plan is better than any set-up plan. Every business is unique, so planning must take into account the marketplace, the company’s position, and the direction of operations before the execution of financial operations.

Improved financial planning raises organizational standards and boosts business performance. Sometimes, a stable financial plan helps decision-makers stay emotionally and mentally strong. In the end, it results in fruitful outcomes. Preparing for emergencies and having a contingency plan help organizations to survive and mitigate financial risks.

For all organizations, concentrating on investment opportunities is crucial. Such investments must be done in diverse sectors. Prudent evaluation should be made when concentrating on procurement initiatives and allocating funds. Using safe investment techniques is crucial for ensuring good returns. Taking into account the aforementioned considerations, it is necessary to make sound financial plans and ensure financial security.

A key component of financial planning is financial self-reliance, which requires an organization to raise capital by abiding by compliance standards. Borrowing money requires a healthy ratio that is around 30–40% of assets. So financial planning is crucial for wealth management/asset management. Organizations must opt for consultancies to get a sound financial plan for better wealth management.

Bottom line

A company’s financial plan includes micro plans for assets, liabilities, profit and loss statements, income and expense records, and sales projections. All of these financial break-even analyses necessitate a written financial plan in order to increase the likelihood of the organization’s success ratio. A financial plan also needs to consider other factors like capital reserves, tax liabilities, insurance coverage, and debt liabilities. Businesses that have better financial planning will be more prepared for unforeseen challenges and will be able to maintain healthy surpluses and reserves. As a result, it will be simple for organizations to survive in this challenging global environment.

For more such Updates Log on to https://fintecbuzz.com/ Follow us on Google News Fintech News