Since the inception of businesses, humans need financial assistance for operations management. Keeping this in mind, banking systems came into the picture. Read on to know more about digital banking solutions.

At every step of the human journey, finance is needed to address necessities. Without the element of the banking process, financial transactions could go haywire. The economy of any country has been vested in the banking systems. “Transparency” is the foundation for building the right financial services. In the olden days, businesses had to enter calculations manually. These entries caused numerous errors and repetitions. As time ticked by, new technologies came into play to improve the efficiency of the banking personnel. The article will introduce you to various banking services and how they have helped to transform financial services.

Online banking

The introduction of technology in banking gave way for innovation in products and services. The initial stages of electronic banking started with the introduction of online banking. These services included limited transactions for bank accounts. The process had to be backed with checking the credibility of the customer to avoid bad debts and fraud. This task was tedious and involved loopholes, causing errors in the loan processing requests.

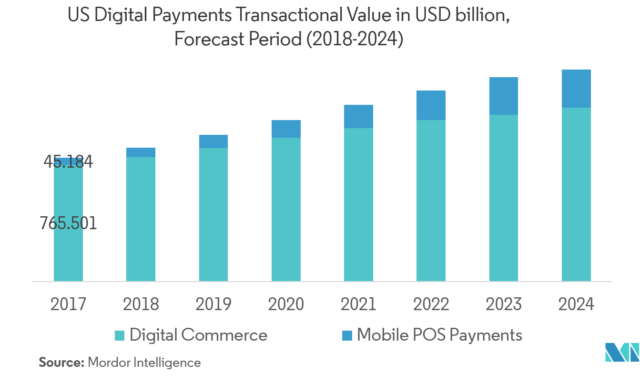

From the graph, it is evident that the digital banking transactions on the Digital Commerce and Mobile POS payments have risen. As indicated above, the transaction value in the Digital Payments amounted to USD 810.6 billion in 2017. The future projections have an important role to play in shaping the digital banking industry.

Products and services

With time, there were changes in the banking systems. With the rising customer demand, banks introduced products and services which could be tailor-made. This trend was backed by cross-selling of third-party products. As awareness rose for these services, customers from various segments were attracted. As some clients had to be given selective privileges banks had to address these concerns and innovate products.

Investment

With the rising financial needs, new sectors came into the picture and introduced investment options. This trend was followed by digitizing customer records to know their purchasing pattern.

These databases assist the banking personnel to introduce offers and products accordingly. After a certain timeframe, customers demanded banking from anywhere and everywhere. This trend gave rise to mobile banking solutions. The customer could add his product and services and raise requests online. This enabled him to track his requests and raise any concerns.

Tracking requests

With the advancement of technology, banking has become so much easier. Customers can track requests and get answers to their queries with banking chatbots. Through these systems, customers are redirected to the concerned banking personnel for the solution to their queries. It makes the process simple and hassle-free on the part of the customers. Digital solutions have made life simpler and enhanced the productivity of the banking systems.

Loans and advances

The processing of loans and advances has evolved helping banks to save time for checking the background of the client. This process has enhanced customer satisfaction and increased the customer base of the banking system. In the current scenario, customers demand is a way to innovate new services. The feedback is directed to the concerned departments for the necessary changes. Digital banking solutions are a means to target new customers with new products and services.

The key takeaways

Banking has no doubt improved the financial systems, but digital banking solutions have increased trust and created a new customer base. Mobile banking has transformed the banking ecosystem taking the banking ecosystem to a new level. The evolution of digital banking has brought a transformation in the financial services addressing the needs of the new generation.