Presently, Risk management is gaining more and more attention and is no longer a buzzword. Slowing economies across the globe and an increase in natural disasters emphasize the need for businesses to make risk management an integral part of their business strategy, instead of leaving it as a policy note.

As businesses have become more networked and interdependent, organizations also become more susceptible on being affected by forces outside their immediate markets and supply chain. Financial risk management shouldn’t be a concern of financial institutions only, but also of those who regulate them and those money is entrusted to them. Risk analysis as a result has gained a mammoth momentum in the recent past, as it not only helps in reducing monetary risks around Direct Lending Investments, but also helps you to keep your eye on the ball.

Increased regulations and changing legislation put more burden on the financial industry to moderate risk. While there has been several Fintech news channels who have reported that bigger companies like Microsoft have also started rolling out newer risk management insider policies to advocate greater emphasis around this topic. The extensive complexity of risk factors makes fintech risk management platforms quite essential. Enterprise-wide, real-time risk mitigation requires deeper integration and more powerful detection abilities than legacy systems can provide.

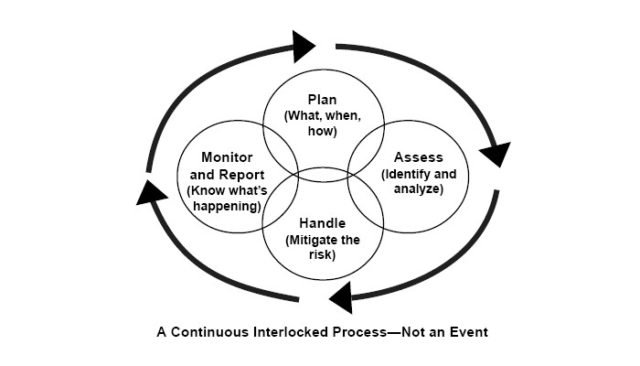

Organizations have begun to look at risk management, not only through a lens of Compliance but also as a driver of value and to ensure survival in a competitive business environment. The two key things among other successful companies do are managing risks proactively and quickly adapting themselves to the changing market situations.

Here we have listed some of the risk management trends for 2020, let’s have a look,

- Technology for effective risk management

Traditionally, business models were enabled through the use of technology. Presently, innovative technology drives new business models. Technology is progressively becoming the source of business disruption for example Amazon uses technology effectively to disrupt traditional retailers. In the domain of risk management, technology has double emerging considerations. One, where technology is assuming a significant role in transforming companies to move from compliance to performance and adopting effective and efficient risk management practices. Other rising consideration for risk managers, is to look at the rapidly changing technology landscape as a source of critical risk to the existing business model and long-term survival of the organizations.

- Convergence of risk oversight with planning

Organizations seem to be struggling to incorporate their risk oversight with the development and execution of their strategy. There requirement to be an explicit focus on the interrelationship of strategy development, risk-taking, and execution. Looking at the relationship between risk and return, organizations are broadly considering risk management inputs for strategic planning. Developing trends to this regard is, boards embedding risk oversight into the management compensation structure and CROs (Chief Risk Officers) expected to validate the suspicions underlying strategy and utilize this to advise the business on risk-taking.

- Risk Analytics

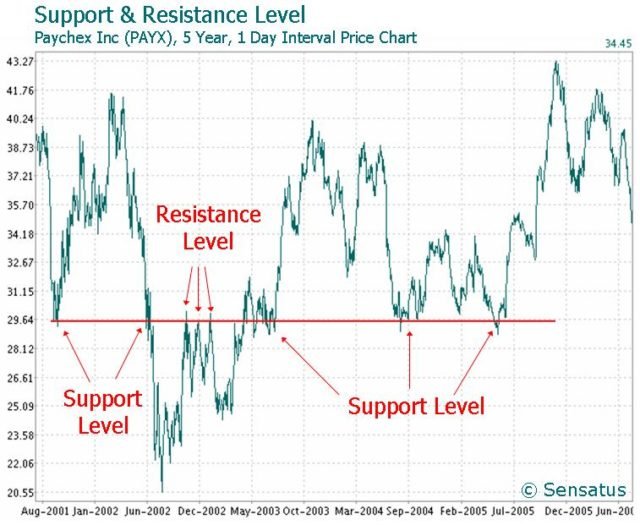

One, among the risk management trends that are emerging rapidly, is risk analytics that is the utilization of advanced analytics and data mining techniques to accomplish risk management objectives. Organizations are progressively focused around using a data-driven approach for opening the most amount of information hidden in their data to successfully manage their risks. The key benefits of risk analytics are the capacity to expand risk factors to incorporate particulars specifications which provide a more holistic and factual basis for risk management. Moreover, it can be utilized to enhance behavioral scorecards with predictive models to analyze transactions in order to additionally refine and enhance early warning signs.

- Focus on emerging risks

Numerous organizations do no conventional assessments of rising strategic, market, or industry risks. Organizations should be increasingly proactive in integrating emerging risks into daily business operations. It’s insufficient to focus only on those events for which the probability of occurrence and likely effects can be identified. Risk assessment is largely inward focused as compared to being forward-looking and externally focused. Detailed analysis of competitor strategies/ benchmarking and scenario planning are not widely used. Organizations presently have begun evaluating the “unknowns” by identifying exposure and correlation between external trends and risks that could eventually result in a disastrous impact on their own survival. Some organizations use situation planning and stress testing broadly in their risk assessments to objectively evaluate impact because of emerging risks.

- Treasury as a strategic business partner

Proactively managing risks have led to changes in the responsibility of numerous groups inside the organization. One of the trends we see related to risk management is, the role played by the treasury dept. Treasury is becoming more of a business partner, working with units of business and over functions to ensure that sound decisions are made, particularly in the domain of financial risk management. Today treasurers are moving away from merely focusing on liquidity issues to becoming more strategic for the organization. They present to Board, work closely with top executives, business unit heads, Procurement, etc. to increase the overall organizational risk intelligence.

Aashish Yadav, Content-Editor, FintecBuzz

Aashish is currently a Content writer at FintecBuzz. He is an enthusiastic and avid writer. His key region of interests include covering different aspects of technology and mixing them up with layman ideologies to pan out an interesting take. His main area of interests range from medical journals to marketing arena.