Technology is the backbone of businesses enabling them to target niche markets. This need has targeted business and elite customers for designing portfolios. Considering a large market for investments, WealthTech and Fintech come into play. Let’s understand the concepts in more detail!

Identifying customer segments

In the growing markets, companies have entered various sectors. This expansion has helped them to target diverse customer segments. The banking personnel has to identify these needs and prepare tailor-made programs. In this scenario, portfolio designing and allied programs are important for businesses to identify present and prospective investment opportunities. Weathtech is a mechanism for businesses to identify these opportunities. The software is accompanied by machine learning, AI, and Big data technologies to provide effective solutions for investment decisions. Data analytics in this field has an impact on the decision-making capabilities of investors.

Wealth Tech Services

WealthTech is the ultimate key for investors to handle their finances suitably. To go back in time, the term WealthTech was coined in the early 21st century. The goal of the technology was to help professional institutions to manage their finances. This technology has enabled professionals to arrange their finances in a better manner. WealthTech has paved a path for many services to the doorstep of consumers. Furthermore, the market segmentation and target markets are easy to identify considering customer feedback and surveys.

Investment advice

WealthTech is considered a subset of Fintech as it advises customers on several investment fronts. As this gets larger in the financial markets, compliances are the most important aspect.

WealthTech markets are divided into B2C and B2B. In this, context, the investment options remain the same. The decisions of investments differ with risk, algorithmic projections, platforms, and the preferences of the markets. In the WealthTech Arena, digital identification is of paramount importance. This process saves the banking ecosystem and the investors from numerous frauds. In WealthTech digital identification can be in the form of a video call or in-person verification. This facilitates easy account creation and identifies purchasing power of the customer. In Fintech, this process of KYC captures the details of the investor through physical documents. Once this information is captured, the system shows the relevant records of the customer with their portfolio.

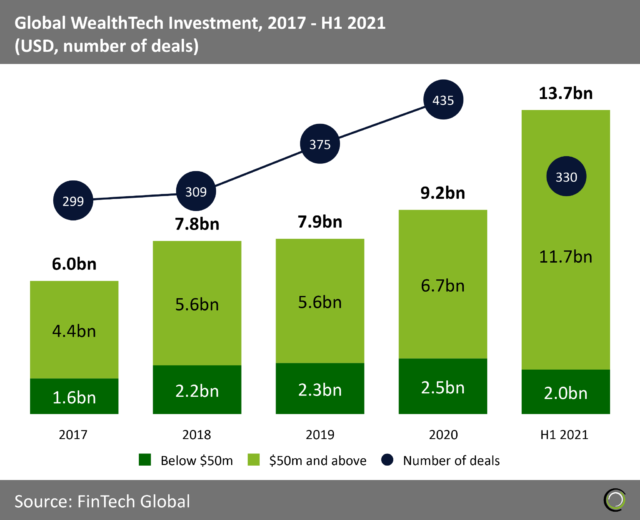

Wealth Tech Statistics

As seen in the above graph, it clearly shows the increase of investments in the Wealth Tech Arena. Looking at the numbers in-depth, wealth tech investment increased from 2017 to H1 2021 at a CAGR of 26.6%. This shows that the investments have increased on a fourfold growth through these years.

Customer Convenience

Fintech has opened a plethora of tools for the banking sector and customers. On the part of the customer, “convenience” is the buzzword. With mobile and internet banking banks are at the fingertips of the customers. Banking chatbots help the customers to find the right product and suggesting them with investment options. This makes the process of identifying the customer preferences and designing banking products accordingly.

Portfolio design

Wealth management is aimed at affluent clients with a diverse portfolio. These clients are targeted by financial advisors who in turn present them with suitable products. In this process, the banking institutions have to address the needs of the market and individuals. The wealth management program is aimed to advise business professionals to diversify their portfolios. It enables them to invest in particular stages and increase ROI.

The final word

Considering the fact of returns investment options should be diverse. This segmentation can enable investors to watch for markets and their risks. Financial advisors have to target investors with the relevant products. This makes it easy to facilitate decision-making and other important facets.