Today, the banking system is evolving dynamically to become more consumer-centric. Corporate banks are highly optimistic and are now focusing on the demographically active segment i.e. millennials. Millennials, also called Gen Zs, are known as the “instant and now” generation as they get things done quickly. Millennials are a niche market where corporate banking entities are harnessing new opportunities.

Presently, the corporate banking sector is facing multiple challenges like the outbreak of Covid-19, a spike in the inflation rate, a global economic slowdown, low-interest rates, and fluctuation in consumer demand. The above global challenges are hindering the corporate banking sector. Banking entities offer their services to business individuals, commercial enterprises, and small & medium enterprises(SMEs).

The biggest challenge before banking entities is engaging this instant and now-generation. It requires transformational changes in their services and products as the existing ones are no longer relevant. There is a need to provide easy and user-friendly access to banking services. Enhancing user experience (UX) will be helpful to attract the next generation towards the corporate banking system. It is highly essential to build relationships and connect with these young users.

Enhancing user experience (UX) will be helpful to attract the next generation towards the corporate banking system.

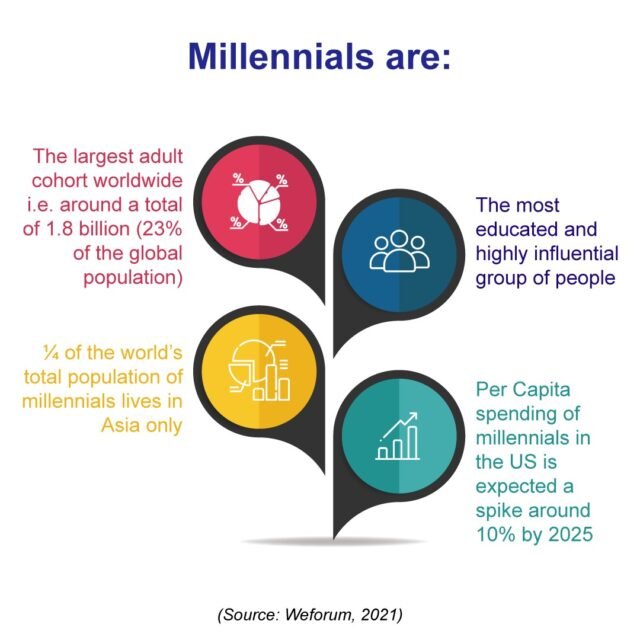

Millennials are the influencing generation, and their behaviors impact worldwide economies. Moreover, it is a fact that they are far better at gaining education and accumulating wealth as compared to other generations. Therefore, corporate bank entities need to adjust their services to rapidly changing client needs. Facilitating quick services using advanced technology can be fruitful in attracting the next generation.

Now, the time has come to revamp traditional banking methods and incorporate new tech to transform the services. Artificial Intelligence (AI), cloud computing, blockchain technology, data science, and robust security features can help engage Gen Zs. Technology-based solutions and integrated digital banking networks can bring hassle-free experiences to millennials. Banks can enhance the financial literacy of Gen Zs, making a difference.

Banking services must be cost-effective, time-saving, and customer-centric. Easy availability of credit and quick payment facilities through digital banking can help millennials engage in banking activities. Instant finance and easy availability of capital for business personnel and entrepreneurs can help to onboard the next-gen in the banking system. Facilitating and engaging the young brigade is a win-win situation for both corporate banks and the next-gen.

Corporate banks can use advanced technologies to attract the next-generation tools in banking functions. These functions include back-office operations, CX, marketing, delivery of services, risk management, and compliance. Furthermore, technology can be used for easy data analysis by AI, speedy workflow, and quick technical support. Corporate banking systems can use technology for data gathering, remittance processes, conflict resolution, and smooth user experience during payment operations. The use of tech solutions in the banking system can boost the inclusion of Gen Zs into banking operations.

Way forward

Corporate banks need to plan appropriately, to get millennials onboard in the banking system. Corporate banks must offer more personalized banking services to attract & engage next-gen. Maximum automation can provide smooth UX and quick results while performing banking operations. Corporate banks must facilitate easy investment banking operations, robust security to avoid loss and risk of fraud, and optimal use of blockchain ledgers to keep track of digital transactions to engage millennials. Corporate banking entities need to keep pace with the ongoing trends to stand strong in the competition. Companies need to switch from a product-centric approach to a customer-centric approach, to enhance the customer journey.

For more such Updates Log on to https://fintecbuzz.com/ Follow us on Google News Fintech News