1. Tell us about your role in NASGO?

I am Eric Tippetts, Co-Founder of NASGO, a platform and ecosystem for the development of distributed applications on the Blockchain. We built the NASGO platform to solve our own business issues. I have a partner in NASGO, Steve Chiang. We are both serial entrepreneurs. We grew a business in China. In 2015, we did $3 billion business in USD, and $3.5 million in Chinese in six months. We broke traditional infrastructure as it is today. We were getting shut down by firewalls, and our accounts were hacked into nine times. My bank accounts were literally being frozen because the bankers thought we must surely be involved in some kind of fraud, but we were not. We built the NASGO blockchain to solve our issues. This wasn’t to solve other people’s issues; it was to solve our issues.

2. Can you tell us about your journey into this market?

When we built this, we wanted to build it to build an infrastructure so we could do global commerce in a resistance-free way. We started to realize this is something the world needs.

As an entrepreneur, you’re an underdog. You get beat up all the time by infrastructures, by government, by people every which way.

3. How do you think technology is developing the Finance Sector?

Typically, what people are doing is attempting to create high-level supply chain management and banking protocols, trying to build complex algorithms to solve complex issues in finance. We see developers building complex programs designed to serve as future solutions for problems people don’t actually have. We believe it is better to look at blockchain in the finance sector (and in every sector that includes a financial transaction) as a way to create a digital asset that is tracked and open ledger. It fosters trust by making it easy to see what somebody is doing on the blockchain and to know that assets are being transmitted accurately and to the places they are intended to be.

4. How has introduction of blockchain technology contributed in the development of financial processes?

Imagine a world in which every region could eliminate the need to carry physical currency – that from their mobile device they could hail a ride, get a morning donut, purchase whatever they need in whatever currency they prefer-USD, Bitcoin, NSG-from the interface on their phone. Financial processes become easy, transparent and are fully recorded for whatever accounting and reporting purposes you need. It becomes simpler to accomplish life and business as well as to sell or monetize your content, your products and your services, without complexity and with full information that lets you know where your customers are, where to centralize your resources, and what you are doing that resonates well. Ideally, blockchain technology should remove the complexity and resistance factors that prevent individuals and small businesses-especially the underdogs who for whatever reasons are unable to get a loan, can’t get traditional funding-to establish trust, to build revenue traction and create business that was formerly unavailable, to allow them to meet with success.

5. In what ways can your token benefit your clients?

Our own token, NSG, can benefit our clients by allowing them to create a digital asset-a unit of measure-that they can use to build loyalty and exchange of value with their fans and customers easily. Some may use their tokens primarily to market to their customers and garner interest for their local businesses for photography, baked goods, retail merchandise, etc. The tokens create a gamified experience that encourages customers to come into the business and redeem their tokens for discounts or free goods. But as customers want to buy access to content, VIP tickets or order products and experiences from you, they can use NSG to purchase your branded tokens in a quantity that allows them to complete an entire purchase through our VAPR Augmented Reality application using the Amico marketplace app. As they do, the transaction is transparent and the revenue you’ve earned hits your wallet immediately and can be used as is for your own purchases or can be converted within your wallet to USD or to any other supported currency you desire.

6. How do you differentiate your Cryptocurrency wallet from other such wallets available?

Our NASGO wallet is designed for flexibility and transparency, and for ease of use with the VAPR and Amico apps we’ve created to allow any person to engage and transact with each other from any part of the world, with no traditional internet connection required.

7. Do you agree that blockchain is redefining financial and cybersecurity?

Yes. The Blockchain’s transparency eliminates the vulnerability that has plagued the internet by making all transactions evident and transparent. There will still be cybersecurity concerns-primarily about the vulnerability points that exist at the endpoints where assets move onto and off of the blockchain, and we will require increasingly more development as time progresses to ensure that all transactions are safe. But as for the blockchain itself, the transactions that occur on chain are not only transparent and evident by the very architecture of the blockchain, but they allow organizations and individuals to build the trust that allows them to participate across the blockchain ecosystem with increasing levels of ease.

8. What advice would you like to give to the Startups?

Increasingly, you need to find ways to engage and transact globally. If the programs you use are only effective in your own country, you need to find the ways to create a distinct and trusted brand (through your branded token), but you also need a way to make your transactions work across the regions that use WePay instead of PayPal, for example. These are the goals we’ve set out to achieve with our initial applications, the VAPR app for transmitting and receiving content and making offers, and the AMICO merchant app that allows you to seamlessly conduct financial transactions across all of these platforms.

As far as business advice, I would say that my #1 suggestion is to be very careful of your five closest friends and the words you let in your life that become beliefs. That has been a really hard lesson for me to learn. I let people around me start to tell me what I should believe. Initially, I Iistened to the wrong people that I realized later on didn’t have my best interest at heart. They were leading me to a place that would benefit them. That was a really hard lesson because it relates to humanity. You start to wonder if humanity is good or bad? I choose to this day to believe that humanity is good, and people want to do good. But you need to be very careful about what and who you allow into your experience and what self-talking you allow into your life, and to become beliefs.

9. What is the Digital innovation in Fintech Industry according to you that will mark 2019?

We have said many times that 2018 was about education, but 2019 is about practical use. The ability for anyone, anywhere to get tokenized and transact their content, their talent, communicate their message to the world and to use this technology for the betterment of humanity is the giant hurdle we are reaching in 2019.

10. How do you prepare for a Technology-centric world?

In my opinion, you prepare by thinking globally instead of locally, and by being open to the new and better ways of achieving your goals through tools you already own, such as your Android or iOS phone.

11. Can you tell us about your team and how it supports you?

We have a sizeable team of developers in China that support us nonstop with application development, to make it so easy to tokenize that we can be effective in making tokenization easy to use and inexpensive enough to let the technology become available and pervasive to every part of the world.

12. What are the major developments you are planning, in recent time?

We’re planning the first wide-scale launch of VAPR in July, 2019, with the launch of the first tokenized music albums and movies with major music and entertainment artists. So be sure to follow us at NASGO.com and on social media to see all of our updates.

13. Which Book are you reading these days?

The book I am reading right now is “The Slight Edge: Turning Simple Disciplines into Massive Success and Happiness,” by Jeff Olsn. It’s about taking daily small actions in areas of your life that attracts things into your life over time. I am really enjoying the book. It has very similar values and core concepts as my own book, “To The Top.”

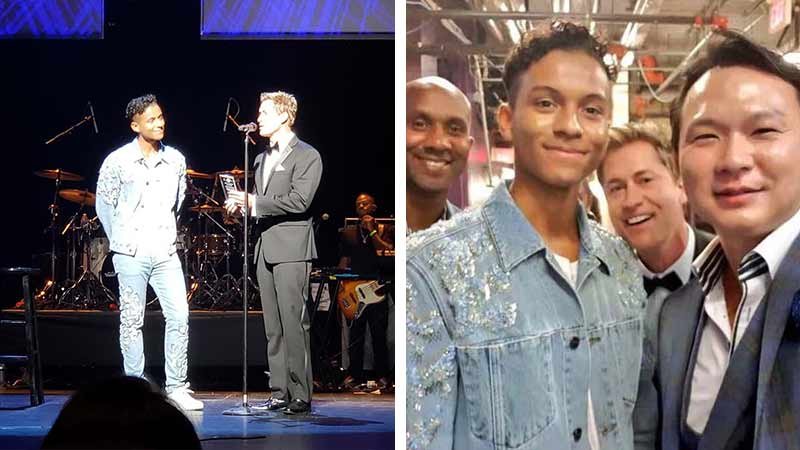

14. We have heard that you have a very joyful work culture, we won’t mind having a look at some of the pictures?

15. Can you give us a glance of the applications you use on your phone?

The three apps I use the most are Amico, VAPR, and Podcast and Music. I am a huge consumer of content in podcasts. I love learning from others and hearing people’s perspectives and insights as we are striving to become better, to evolve and provide more value to the world. This gives us purpose and fulfillment. I wake up to music and end my day with music. Music can create energy states in your body. Whatever mood you want to be in, music can put you there. Very powerful! The final app I use is a five-minute journaling app. Every morning and every evening I write down three things I am grateful for, three things that I want to accomplish that will make the day great and one affirmation starting with “I Am…”. These are all very important in many areas of your life.